Company Tax Computation Format Malaysia

This page is also available in.

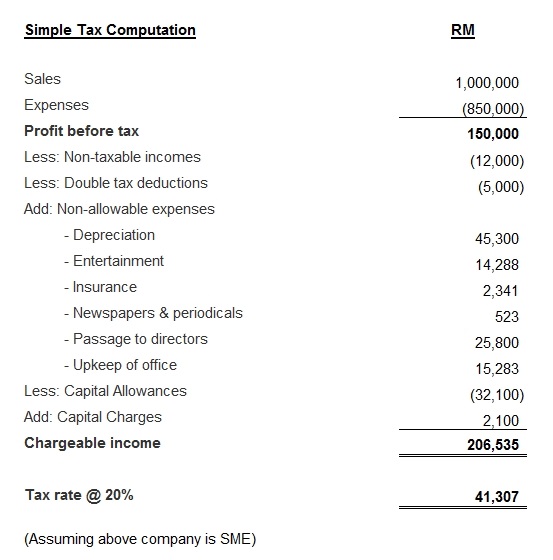

Company tax computation format malaysia. Resident company other than company described below 24. Chargeable income myr cit rate for year of assessment 2019 2020. Melayu malay 简体中文 chinese simplified malaysia corporate income tax rate.

Income attributable to a labuan business. Income tax computation format for companies last updated at may 29 2018 by teachoo it is prepared taking into account different cases of expense disallowed learn more. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

5 under the self assessment system an assessment is deemed to have been made by the director general of inland revenue on the date the tax return is submitted the above statement is. Company tax computation format malaysia excel. Check no akaun cimb bank check bil tnb online check syabas water bill online check blacklist ke luar negara cimb account number 14 digit check saman trafik online cheras selangor or kuala lumpur child care centre act 1984.

Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra. Capital allowance is only applicable to business activity and not for individual. Where a company commenced operations.

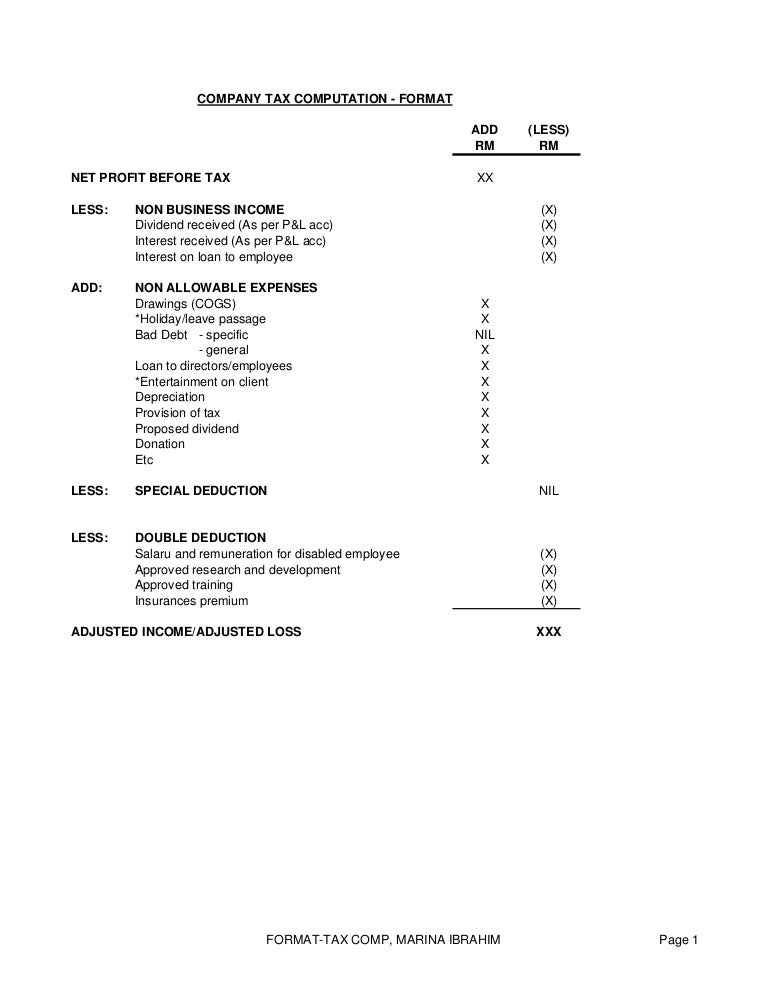

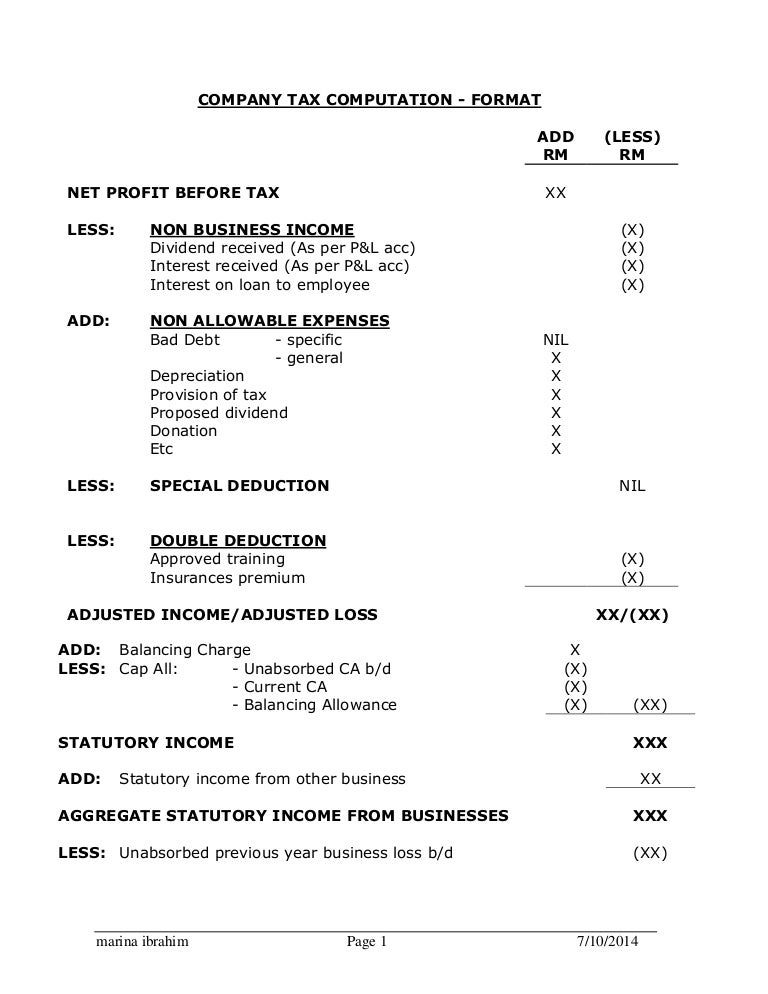

Basic format of tax computation for an investment holding company pdf 497kb basic format of tax computation for a shipping company xls 105kb basic format of tax computation for a development and expansion incentive dei. Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax.

The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business. You may refer to the following templates for guidance on how to prepare your tax computation for specific industries. Lee arrived in malaysia on 1 june 2010 and has been.

A true b false c true only for companies d true only for individuals and non corporates 6 lee is a canadian employed by a malaysian company. They need to apply for registration of a tax file.